How to Consolidate Student Loans: A Complete Guide to Lowering Your Payments and Interest Rates

Consolidating student loans is a great way to simplify your debt and potentially lower your monthly payments. With the rising cost of education and the burden of student loans, many borrowers seek ways to streamline their debt repayment process. This guide will walk you through the steps of consolidating your loans, the benefits of doing so, and the best tools and products available to make this process easier and more effective.

What is Student Loan Consolidation?

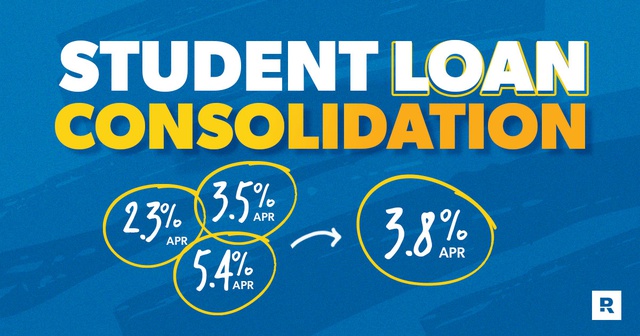

Student loan consolidation is the process of combining multiple federal student loans into one loan. Instead of making multiple monthly payments to different loan servicers, consolidation allows you to make a single payment to one servicer. This can help simplify the repayment process and might even result in a lower monthly payment depending on your interest rates.

Consolidation can be done through the federal Direct Consolidation Loan program or through private lenders. While federal consolidation offers several benefits, such as access to income-driven repayment plans, private consolidation may offer lower interest rates for those with good credit. Understanding these options is crucial for making an informed decision.

Benefits of Consolidating Student Loans

Consolidating student loans has several benefits, including simplifying your finances, reducing your monthly payments, and potentially lowering your interest rate. Let’s explore these benefits in more detail:

- Simplified Payments: One of the most immediate benefits is the ease of managing just one loan instead of multiple ones. With just one payment to track, you’re less likely to miss payments, which can lead to penalties or damage to your credit score.

- Lower Monthly Payments: If you consolidate federal loans, you may be able to extend your repayment term, which can lower your monthly payment. Although this means you may pay more in interest over the life of the loan, the short-term relief can be significant.

- Access to Income-Driven Repayment Plans: Federal consolidation allows you to access income-driven repayment plans that adjust your payments based on your income. This can be especially helpful if you’re struggling financially.

- Loan Forgiveness Opportunities: Consolidating federal loans can also put you on a path to loan forgiveness through programs like Public Service Loan Forgiveness (PSLF), if you qualify.

- Potential Lower Interest Rates: If you have a high-interest rate on private loans, consolidating them with a private lender may result in a lower rate, especially if you have a good credit score.

How Does Student Loan Consolidation Work?

When you consolidate student loans, the process involves taking your existing loans and combining them into one loan with a new interest rate. Here’s a simple breakdown of how the process works:

- Choose the Loan Type: You can choose between consolidating through a federal Direct Consolidation Loan or a private lender. Each option has its pros and cons, so it’s essential to evaluate them carefully.

- Understand the Interest Rate: Federal consolidation uses a weighted average of your current interest rates, rounded up to the nearest one-eighth percent. Private consolidation, on the other hand, might offer a fixed or variable rate depending on your credit score and the lender’s terms.

- Choose a Repayment Plan: Federal consolidation offers different repayment plans, such as the standard, extended, or income-driven plans. Private consolidation offers varying repayment options based on the lender’s terms.

- Complete the Paperwork: Whether you’re consolidating federally or privately, you will need to complete an application. Federal consolidation is free, while private consolidation may involve fees.

- Start Your New Payment Plan: After your loans are consolidated, you will begin making payments on your new loan.

Top Products for Consolidating Student Loans

Now that we’ve discussed the concept and benefits of consolidating student loans, let’s explore some real-world products that can help you consolidate your loans efficiently. Here are five tools and platforms that can aid in the student loan consolidation process:

1. SoFi Student Loan Consolidation

SoFi is a popular online lender offering both student loan refinancing and consolidation. With competitive interest rates, flexible terms, and an easy application process, SoFi stands out as one of the top choices for consolidating student loans.

Pros:

- Competitive fixed and variable interest rates

- No fees for refinancing or consolidation

- Flexible repayment options

Cons: - Requires good credit for the best rates

- Only available for private loans

| Feature | Details |

|---|---|

| Interest Rates | 3.74% to 8.49% (fixed) |

| Repayment Terms | 5 to 20 years |

| Eligibility | Good credit, income verification |

| Fees | None |

| Customer Service | Excellent |

How to Buy: Visit SoFi to check eligibility and apply.

2. Earnest Student Loan Refinancing

Earnest is another private lender offering student loan consolidation with customizable repayment options. They provide low rates and flexible terms, allowing you to tailor your repayment plan to fit your budget.

Pros:

- No fees for refinancing

- Flexible repayment terms (from 5 to 20 years)

- No prepayment penalties

Cons: - Strict credit requirements

- Not available for federal loans

| Feature | Details |

|---|---|

| Interest Rates | 2.99% to 7.99% (fixed) |

| Repayment Terms | 5 to 20 years |

| Eligibility | Good credit, proof of income |

| Fees | None |

| Customer Service | Excellent |

How to Buy: Apply through Earnest.

3. LendKey Student Loan Consolidation

LendKey connects borrowers with community banks and credit unions, offering competitive rates for loan consolidation. It’s an excellent choice for those who want to support local institutions.

Pros:

- Community-based lender support

- Low interest rates for creditworthy borrowers

- No fees for refinancing

Cons: - Limited availability of lenders in some regions

- Requires good credit for the best rates

| Feature | Details |

|---|---|

| Interest Rates | 3.99% to 8.25% (fixed) |

| Repayment Terms | 5 to 20 years |

| Eligibility | Good credit, US residents |

| Fees | None |

| Customer Service | Good |

How to Buy: Apply via LendKey.

How to Choose the Right Student Loan Consolidation Option for You

Choosing the right student loan consolidation product depends on several factors, including your credit score, the type of loans you have, and your long-term financial goals. Consider the following when selecting a lender:

- Interest Rates: Compare rates across different lenders to ensure you’re getting the best deal.

- Repayment Terms: Look for flexible repayment options that fit your budget.

- Eligibility: Make sure you meet the qualifications for consolidation, especially if you’re considering private lenders.

- Customer Service: Choose a lender with a reputation for good customer service and responsive support.

How to Apply for Consolidation

Applying for student loan consolidation is a relatively simple process. For federal loans, you can apply through the Federal Student Aid website. For private loans, visit the lender’s website to check your eligibility and submit your application.

What Problems Does Student Loan Consolidation Solve?

Student loan consolidation addresses several issues that borrowers face when managing multiple loans. Here’s a breakdown of the problems that consolidation can solve:

1. Multiple Payments to Different Servicers

If you have multiple student loans, each may be serviced by different companies, making it challenging to keep track of due dates and payment amounts. This can lead to missed payments, confusion, and even late fees.

Solution: Consolidating your loans combines them into one loan with a single monthly payment to one servicer. This makes it easier to manage your finances and ensures you won’t miss any payments due to administrative confusion. 🧾

2. High Interest Rates

Student loans often come with high interest rates, particularly for private loans. If you’re paying interest at a high rate, you’re accumulating more debt over time, making it harder to pay off your loans.

Solution: Consolidating through a private lender may allow you to secure a lower interest rate. For federal loans, consolidation may not lower the rate directly but can help you access other repayment options that could reduce the financial burden.

3. Difficulty in Managing Multiple Loan Terms

If you have federal and private student loans, each type of loan may have different repayment terms, interest rates, and conditions. This makes it difficult to maintain a consistent repayment strategy.

Solution: Student loan consolidation simplifies this by merging multiple loans with varying terms into one loan. This streamlines your repayment strategy, helping you to stay on top of your payments.

4. Access to Loan Forgiveness Programs

Federal student loans offer the possibility of loan forgiveness through programs like Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness. However, these programs often have specific requirements, including a certain number of years spent in qualifying employment.

Solution: Consolidating federal loans can allow you to qualify for these programs if you’re eligible, helping you eventually eliminate your debt after a set number of years of qualifying payments.

5. Financial Stress and Uncertainty

Managing student loans can be emotionally and financially stressful. If you’re struggling to make multiple payments or managing complex loan terms, the burden can feel overwhelming.

Solution: Consolidating your student loans can reduce stress by simplifying your payment process. With just one payment to make each month, you’ll have greater peace of mind and can focus on other financial priorities.

Why Should You Consolidate Your Student Loans?

While consolidating student loans may not be the right option for everyone, there are several good reasons to consider it. Here’s why you might want to consolidate:

1. Streamlined Loan Management

By consolidating, you combine multiple loans into a single loan, making your finances much easier to manage. You’ll only need to deal with one lender, one interest rate, and one monthly payment. This simplicity helps you stay organized and reduce the chances of missing a payment.

2. Potential for Lower Interest Rates

If you’re consolidating private loans with a high interest rate, you may be able to secure a lower rate, depending on your creditworthiness. This can reduce the total amount of interest you pay over time, making your loans more affordable.

3. Access to Repayment Flexibility

Federal student loan consolidation offers access to a variety of repayment plans. Some options, like income-driven repayment plans, can reduce your monthly payments based on your income and family size. This can be a huge relief if you’re struggling financially.

4. Loan Forgiveness Opportunities

For those with federal student loans, consolidating can help you get on track for programs like PSLF. If you work in public service or other qualifying fields, consolidating your loans can make you eligible for forgiveness after 10 years of qualifying payments.

5. Longer Repayment Terms

If you want to lower your monthly payments, consolidating can allow you to extend the length of your loan, giving you more time to repay your balance. However, keep in mind that this may increase the total amount of interest paid over the life of the loan.

Is Consolidating Your Student Loans Worth It?

When considering whether consolidation is right for you, it’s important to weigh the pros and cons. Let’s look at both sides of the equation to help you decide if consolidation is worth it.

Pros of Consolidating Your Student Loans:

- Simplifies Payments: One loan, one payment — it’s as simple as that.

- Lower Monthly Payments: Consolidation may extend your loan term, resulting in lower payments.

- Potential Interest Rate Reduction: Private loan consolidation can lead to a reduction in your interest rate.

- Flexible Repayment Options: Federal consolidation opens doors to income-driven repayment options, potentially reducing your monthly payment.

- Path to Loan Forgiveness: Consolidation could make you eligible for loan forgiveness under certain federal programs.

Cons of Consolidating Your Student Loans:

- Higher Total Interest: Extending your loan term can increase the total amount of interest paid over the life of the loan.

- Loss of Loan Benefits: Some benefits, such as access to federal loan forgiveness programs, may be lost if you consolidate federal loans with a private lender.

- Longer Repayment Time: While it lowers monthly payments, consolidation can also extend the repayment term, meaning you’ll be paying off your loan for a longer period.

Ultimately, whether consolidating your student loans is worth it depends on your personal financial situation, goals, and the types of loans you have. For many, the benefits of simplification and lower monthly payments outweigh the cons. However, it’s important to consider the long-term effects before making your decision.

How to Buy and Where to Buy: Tips on Securing the Best Deals for Loan Consolidation

If you’ve decided to consolidate your loans, you may be wondering how to go about it. Here’s a detailed look at the process, along with advice on where to apply for consolidation and how to secure the best possible deal:

1. Federal Loan Consolidation

- Where to Apply: If you have federal student loans, you can apply for consolidation through the U.S. Department of Education’s Federal Student Aid website.

- Cost: Federal loan consolidation is free and doesn’t involve any application fees.

- Process: Simply complete the online application form, which takes approximately 30 minutes. You’ll need to provide information about your loans and current servicers.

2. Private Loan Consolidation

- Where to Apply: Private consolidation is done through various private lenders. As mentioned earlier, some popular platforms include SoFi, Earnest, and LendKey.

- Cost: While consolidation through private lenders may not involve direct fees, there may be interest rate adjustments and other terms to consider.

- Process: Apply directly on the lender’s website. Most lenders require you to provide personal and financial information to assess your eligibility. You can expect a decision within a few days, and once approved, you’ll receive a consolidation offer.

3. Tips for Finding the Best Deals

- Compare Lenders: Whether consolidating federally or privately, always compare interest rates, fees, and repayment terms across different lenders to ensure you’re getting the best deal.

- Check for Special Offers: Some lenders offer promotional discounts for setting up automatic payments or for being a member of certain organizations (like alumni groups).

- Understand Your Loan Terms: Before signing any agreement, read the fine print to ensure you’re aware of all fees, interest rates, and conditions associated with consolidation.

Take Control of Your Student Loan Debt

By consolidating your student loans, you can reduce the complexity of your debt, lower your monthly payments, and even save on interest over time. Whether you choose to consolidate federal loans or private loans, the goal is to ease your financial burden while ensuring you stay on top of your payments. Consolidation can also help you regain focus on your financial goals, such as saving for the future, buying a home, or even starting a family.

If you’re struggling to manage multiple student loan payments or overwhelmed by the amount of debt, consolidating your loans could be a powerful tool to streamline your finances. And with the ability to take advantage of loan forgiveness programs and flexible repayment plans, it might just be the key to finally clearing your debt and moving forward.

Before proceeding with consolidation, be sure to thoroughly research all of your options, weigh the pros and cons, and consider how consolidation will impact your long-term financial goals. Whether you are looking for lower interest rates, easier management, or access to forgiveness programs, the right loan consolidation choice can be an invaluable step in your financial journey.

How to Get Started

Now that you have all the necessary information, it’s time to take action. Here’s how to get started with consolidating your student loans:

- Evaluate Your Loans: Gather all of your student loan information, including interest rates, servicers, and current repayment terms. This will help you understand your options.

- Consider Your Goals: Decide what you want to achieve with consolidation—whether it’s reducing your monthly payments, simplifying your repayment process, or qualifying for loan forgiveness programs.

- Compare Options: Check out both federal and private loan consolidation options, paying close attention to interest rates, repayment terms, and any potential fees.

- Apply for Consolidation: Whether you’re applying for a federal Direct Consolidation Loan or a private loan consolidation product, begin the application process with the lender or servicer that fits your needs.

- Start Making Payments: Once your consolidation is complete, be sure to stay on top of your new payment schedule. You may even want to set up automatic payments to ensure that you never miss a payment.

By consolidating your student loans, you’re taking a proactive step toward managing your debt and improving your financial situation.

The Best Products and Services for Student Loan Consolidation

When you’re considering consolidating your student loans, it’s important to explore various options that cater to different needs. Below, we dive into some of the most popular and reliable platforms offering student loan consolidation services, along with detailed comparisons of their features, pros, cons, and prices. This will help you find the best product for your situation.

1. SoFi Student Loan Consolidation

SoFi is one of the leading platforms offering student loan refinancing and consolidation services. With its competitive interest rates and unique features, SoFi is a great choice for borrowers looking to consolidate their student loans into one manageable payment.

Pros:

- Low Interest Rates: SoFi offers some of the lowest interest rates in the industry for borrowers with good credit.

- No Fees: There are no application, origination, or prepayment fees.

- Flexible Repayment Terms: Choose from a variety of loan terms ranging from 5 to 20 years.

- Member Benefits: SoFi members can enjoy a host of benefits, including career coaching, financial planning, and discounts on personal loans.

Cons:

- Credit Score Requirements: SoFi typically requires a good to excellent credit score (680 or higher) to qualify for the best rates.

- No Federal Loan Consolidation: SoFi does not offer consolidation for federal loans through the Direct Consolidation Loan program, so you’ll lose access to federal benefits like income-driven repayment plans.

Price:

- Interest Rates: Starts at 3.49% (variable) and 4.99% (fixed).

- Loan Terms: 5 to 20 years.

Comparison Table:

| Feature | SoFi |

|---|---|

| Interest Rate | 3.49% (variable) or 4.99% (fixed) |

| Repayment Terms | 5 to 20 years |

| Fees | No fees |

| Loan Type | Private consolidation |

| Pros | Low rates, no fees, career benefits |

| Cons | Requires good credit, no federal consolidation |

2. Earnest Student Loan Refinancing

Earnest is another popular choice for consolidating both federal and private student loans. It stands out because of its customizable repayment terms and unique approach to refinancing based on your personal financial situation.

Pros:

- Customizable Repayment Terms: Earnest offers flexible repayment terms, including the ability to select the exact amount of monthly payment that works best for your budget.

- No Fees: Earnest charges no fees for loan origination or prepayment.

- Low Rates: Offers competitive fixed and variable interest rates.

Cons:

- Credit Score Requirements: Similar to SoFi, Earnest has strict credit score requirements, which may be a barrier for some borrowers.

- No Federal Loan Consolidation: Earnest does not offer federal loan consolidation options, which means you may lose out on federal benefits like deferment and income-driven repayment plans.

Price:

- Interest Rates: Starts at 3.24% (variable) and 4.99% (fixed).

- Loan Terms: 5 to 20 years.

Comparison Table:

| Feature | Earnest |

|---|---|

| Interest Rate | 3.24% (variable) or 4.99% (fixed) |

| Repayment Terms | 5 to 20 years |

| Fees | No fees |

| Loan Type | Private consolidation |

| Pros | Customizable payment terms, no fees |

| Cons | Strict credit score requirements |

3. LendKey Student Loan Consolidation

LendKey connects borrowers with credit unions and community banks for student loan refinancing and consolidation. It’s a great option for those looking to work with smaller, local lenders that offer lower rates and more personalized service.

Pros:

- Lower Rates: LendKey offers some of the lowest interest rates available in the market, especially for borrowers with good credit.

- Wide Range of Lenders: LendKey connects you to various credit unions and community banks, which often offer better rates than traditional banks.

- Flexible Repayment Terms: Offers terms ranging from 5 to 20 years.

Cons:

- Membership Requirements: Some credit unions require you to be a member to apply for consolidation through LendKey.

- Not Available for Federal Loan Consolidation: Like other private lenders, LendKey does not provide options for consolidating federal loans under the government’s Direct Consolidation Loan program.

Price:

- Interest Rates: Starts at 3.74% (variable) and 4.89% (fixed).

- Loan Terms: 5 to 20 years.

Comparison Table:

| Feature | LendKey |

|---|---|

| Interest Rate | 3.74% (variable) or 4.89% (fixed) |

| Repayment Terms | 5 to 20 years |

| Fees | No fees |

| Loan Type | Private consolidation |

| Pros | Low rates, works with credit unions |

| Cons | Membership requirements for some credit unions |

4. Laurel Road Student Loan Refinancing

Laurel Road offers student loan refinancing and consolidation options specifically designed for doctors, dentists, and other healthcare professionals. This could be an excellent choice if you’re in the medical field and want to take advantage of specific benefits designed for high earners.

Pros:

- Specialized for Healthcare Professionals: Laurel Road tailors its offerings to medical professionals, offering higher loan limits and more flexibility.

- Competitive Rates: Offers competitive interest rates for those in the medical field.

- No Fees: Charges no application, origination, or prepayment fees.

Cons:

- Limited to Healthcare Professionals: If you’re not in the healthcare field, you won’t be eligible for this product.

- No Federal Loan Consolidation: Like other private lenders, Laurel Road doesn’t offer federal loan consolidation options.

Price:

- Interest Rates: Starts at 3.25% (variable) and 4.75% (fixed).

- Loan Terms: 5 to 20 years.

Comparison Table:

| Feature | Laurel Road |

|---|---|

| Interest Rate | 3.25% (variable) or 4.75% (fixed) |

| Repayment Terms | 5 to 20 years |

| Fees | No fees |

| Loan Type | Private consolidation |

| Pros | Tailored for medical professionals |

| Cons | Only available to healthcare professionals |

5. CommonBond Student Loan Refinancing

CommonBond offers student loan refinancing and consolidation services with a strong focus on providing a socially responsible way to manage debt. With each loan refinanced, CommonBond helps fund education for students in need.

Pros:

- Social Impact: CommonBond commits to funding education for underserved students through its social impact initiative.

- No Fees: There are no application fees, prepayment penalties, or origination fees.

- Competitive Rates: Offers some of the best rates for borrowers with strong credit.

Cons:

- Credit Score Requirements: Like other private lenders, CommonBond requires a good to excellent credit score to qualify for the best rates.

- No Federal Loan Consolidation: CommonBond does not consolidate federal loans through the Direct Consolidation Loan program.

Price:

- Interest Rates: Starts at 3.74% (variable) and 4.99% (fixed).

- Loan Terms: 5 to 20 years.

Comparison Table:

| Feature | CommonBond |

|---|---|

| Interest Rate | 3.74% (variable) or 4.99% (fixed) |

| Repayment Terms | 5 to 20 years |

| Fees | No fees |

| Loan Type | Private consolidation |

| Pros | Social impact, low rates |

| Cons | Requires good credit |

5 Frequently Asked Questions (FAQ)

1. Can I consolidate both federal and private student loans?

Yes, you can consolidate both types of loans, but you must do so through private lenders if you’re consolidating private loans. Federal loans can only be consolidated through the federal Direct Consolidation Loan program.

2. Will consolidating my loans hurt my credit score?

No, consolidating your loans will not hurt your credit score as long as you continue making timely payments. In fact, consolidating may even improve your credit by making it easier to keep track of payments.

3. Can I consolidate my loans more than once?

Yes, you can consolidate your loans multiple times, but keep in mind that consolidating federal loans more than once will reset your loan term and may impact your access to income-driven repayment plans.

4. Will I lose access to federal loan forgiveness programs if I consolidate my loans?

If you consolidate federal loans with a private lender, you may lose access to federal loan forgiveness programs. However, consolidating federal loans through the Department of Education will allow you to maintain access to these programs.

5. How long does the consolidation process take?

The consolidation process typically takes 3 to 6 weeks, depending on the lender or servicer. However, you can start making payments as soon as your new loan is set up.

Conclusion

Consolidating your student loans can provide a simpler, more manageable way to pay off your debt. Whether you’re seeking lower monthly payments, access to income-driven repayment plans, or the possibility of loan forgiveness, consolidation may be the solution you’ve been looking for. By choosing the right consolidation program, comparing options, and understanding the benefits and drawbacks, you can make an informed decision that will help you regain control of your finances.

Ready to take the next step? Visit the links provided to find the best consolidation products for your needs and start simplifying your student loan repayment today!