Best Dividend Stocks to Buy in 2025: Top Picks for Passive Income

Investing in dividend stocks is a strategic approach to building wealth and securing a steady stream of passive income. As we move into 2025, certain dividend stocks stand out due to their consistent performance, strong financial health, and potential for long-term growth. In this article, we’ll explore the best dividend stocks to buy in 2025, highlighting their features, benefits, and how you can invest in them.

Why People Need Dividend Stocks

Dividend stocks aren’t just for Wall Street pros — they solve real-world financial problems for all kinds of investors. Here are five common scenarios where dividend stocks become essential:

1. Retirees Needing Consistent Income

Many retirees shift from growth investing to income-generating strategies. Dividend stocks provide a predictable stream of cash flow that can replace traditional employment income. Companies like Realty Income are perfect for this, thanks to their monthly dividend payouts.

2. Young Investors Looking to Compound Returns

Young investors can reinvest dividends through a DRIP (Dividend Reinvestment Plan), using dividends to purchase more shares, compounding their portfolio over decades.

3. Wealth Builders Seeking Diversification

Dividend stocks add stability to a volatile stock portfolio. Stocks like Coca-Cola and Johnson & Johnson are blue-chip companies known for weathering economic storms.

4. High-Income Earners Looking for Tax-Efficient Returns

Qualified dividends are often taxed at a lower rate than regular income, making them tax-efficient income streams for high earners.

5. Entrepreneurs Wanting Passive Income

Business owners or freelancers with inconsistent income use dividend stocks as a financial safety net to cover slow months without liquidating assets.

Where to Buy & How to Buy Dividend Stocks

Ready to build your dividend portfolio? Here’s exactly how you can start — from choosing a platform to making your first purchase.

Step-by-Step: How to Buy Dividend Stocks

- Pick a Brokerage Platform

- Choose a platform with low fees, intuitive tools, and access to U.S. and international markets.

- Recommended options:

- Fidelity

- Charles Schwab

- Robinhood (great for beginners)

- M1 Finance (excellent for dividend reinvestment)

- Open and Fund Your Account

- It usually takes less than 10 minutes.

- Fund your account via ACH transfer or debit card.

- Search for the Stock

- Use the stock ticker symbol (e.g., KO for Coca-Cola) to find the dividend stock you want.

- Buy Shares

- Decide how many shares you want.

- Use a market order (buy now) or limit order (set a price).

- Enable DRIP if your broker supports it to reinvest dividends automatically.

- Track and Grow

- Monitor earnings, read company updates, and adjust if needed.

- Use free tools like Yahoo Finance or Seeking Alpha to stay informed.

🔘 Affiliate-Style Purchase Buttons (Examples)

| Broker | Get Started |

|---|---|

| Fidelity | Start Investing on Fidelity |

| Robinhood | Open an Account on Robinhood |

| M1 Finance | Start Dividend Investing with M1 Finance |

Detailed Product Reviews: Top Dividend Stocks 2025

Here’s a breakdown of each top dividend stock, with features, benefits, and price/performance analysis.

Realty Income Corporation (O)

- Industry: REIT / Real Estate

- Dividend Yield: 5.9%

- Dividend Frequency: Monthly

- 2024 Share Price Range: $50 – $65

- Why it stands out: “The Monthly Dividend Company” — perfect for retirees!

Use Case: Passive income seekers and retirees needing regular monthly income. Tech Benefit: Built-in reinvestment program through most brokers.

Pros

- Monthly income

- Low volatility

- Reliable tenant base

Cons

- Sensitive to interest rates

- Slower growth

Johnson & Johnson (JNJ)

- Industry: Healthcare

- Dividend Yield: 3.3%

- Dividend Streak: 62 years of increases

- 2024 Share Price: $150 – $170

Use Case: Investors looking for stability and steady growth. Tech Benefit: Uses AI in pharmaceutical research = future-proofed business.

Pros

- Recession-proof sector

- Long-term reliability

- Growing dividend

Cons

- Lower growth than tech stocks

- Exposure to legal liabilities

Coca-Cola Company (KO)

- Industry: Consumer Goods

- Dividend Yield: 3.0%

- Dividend Streak: 61 years

- 2024 Share Price: $55 – $65

Use Case: Income investors wanting global brand stability. Tech Benefit: Adopts digital transformation and e-commerce logistics.

Pros

- Global brand

- Long dividend history

- Strong free cash flow

Cons

- Slow innovation

- Dependence on sugar-based products

Microsoft Corporation (MSFT)

- Industry: Technology

- Dividend Yield: 0.8%

- 2024 Share Price: $320 – $390

- Key Fact: Fastest dividend growth among Big Tech

Use Case: Growth-focused investors wanting long-term tech exposure + dividends. Tech Benefit: Dominant in AI, cloud, and software licensing.

Pros

- High growth potential

- Consistent dividend raises

- Strong balance sheet

Cons

- Low yield

- Expensive entry point

ExxonMobil Corporation (XOM)

- Industry: Energy / Oil & Gas

- Dividend Yield: 3.8%

- Dividend History: 40+ years

- 2024 Share Price: $100 – $115

Use Case: High-yield investors seeking income from energy. Tech Benefit: Advanced oilfield tech + carbon capture R&D.

Pros

- High dividend

- Strong cash flow

- Resilient during inflation

Cons

- Tied to oil prices

- Regulatory pressure on fossil fuels

Dividend Stock Comparison Table

| Stock | Yield | Frequency | Risk Level | Growth Potential | Reinvestment Options |

|---|---|---|---|---|---|

| Realty Income | 5.9% | Monthly | Low | Moderate | Yes |

| Johnson & Johnson | 3.3% | Quarterly | Low | Moderate | Yes |

| Coca-Cola | 3.0% | Quarterly | Low | Low | Yes |

| Microsoft | 0.8% | Quarterly | Medium | High | Yes |

| ExxonMobil | 3.8% | Quarterly | Medium | Moderate | Yes |

Pro Tips to Maximize Your Dividend Stock Strategy

Before you wrap up your investment plan, here are several power moves to help you get the most out of your dividend stocks in 2025 and beyond:

1. Use Dividend Reinvestment (DRIP)

Reinvesting dividends automatically helps compound your earnings. Over time, this can significantly boost your portfolio’s value — especially if you’re investing in dividend growth stocks like Microsoft or Johnson & Johnson.

2. Diversify Across Sectors

Don’t go all-in on one industry (e.g., only energy or tech). Build a diversified dividend portfolio with holdings from tech, consumer goods, healthcare, real estate, and energy to reduce risk and improve consistency.

3. Keep an Eye on Payout Ratios

A payout ratio shows how much of a company’s earnings are going to dividends. Look for sustainable ratios under 70% for most industries (REITs and utilities can go higher). For example:

- Realty Income: ~85% (typical for REITs)

- Microsoft: ~30% (very sustainable)

4. Track Dividend Growth

Companies that increase their dividends regularly (like Dividend Aristocrats) tend to be financially sound. Johnson & Johnson and Coca-Cola have raised dividends for 60+ years!

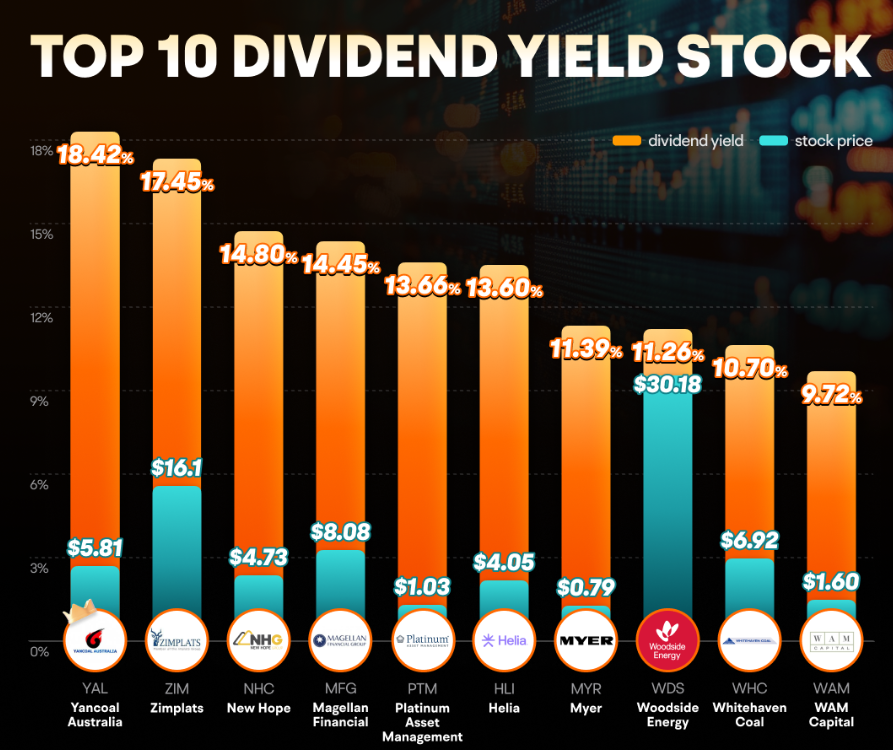

5. Don’t Chase Yield

High dividend yields (over 7–8%) can be a red flag. Focus on total return — yield + stock growth — instead of just the biggest number.

Where to Start Investing Today (Recommended Platforms)

Here are some of the best platforms to begin buying dividend stocks:

| Platform | Best For | Promo / CTA Button |

|---|---|---|

| Fidelity | Long-term investors, research tools | Start with Fidelity |

| Robinhood | Beginners, mobile investing | Open a Robinhood Account |

| M1 Finance | DRIP, auto-investing, pie strategies | Try M1 Finance Now |

| Charles Schwab | Full-service investing experience | Start with Schwab |

| Webull | Active traders, zero commissions | Trade on Webull |

Your 2025 Dividend Blueprint

Dividend stocks are more than just income tools — they’re a strategic way to:

- Build passive income

- Compound long-term wealth

- Diversify your portfolio

- Protect against market volatility

Start with a mix of high-quality companies like:

- Realty Income – monthly income from real estate

- Johnson & Johnson – healthcare giant with stability

- Coca-Cola – iconic brand with global reach

- Microsoft – growth + rising dividends

- ExxonMobil – energy powerhouse

These stocks are battle-tested, dividend-friendly, and backed by strong financials — a perfect starting point for anyone looking to lock in passive income in 2025.

Top Dividend ETFs for Passive Investors

If you’re not ready to pick individual stocks, no problem. These dividend-focused ETFs make it easy to start today:

| ETF | Dividend Yield | Expense Ratio | Description |

|---|---|---|---|

| Vanguard High Dividend Yield ETF (VYM) | 3.1% | 0.06% | Diversified ETF of top dividend-paying companies |

| Schwab U.S. Dividend Equity ETF (SCHD) | 3.5% | 0.06% | Focus on quality dividend stocks with growth |

| iShares Select Dividend ETF (DVY) | 3.9% | 0.38% | High-yield focused ETF, great for income |

| SPDR S&P Dividend ETF (SDY) | 2.9% | 0.35% | Tracks Dividend Aristocrats with long payout records |

How One Investor Built $1,000/Month in Dividend Income

Let’s break down a real-world scenario showing how someone can create a $1,000/month dividend income stream from scratch.

Meet Sarah — The Long-Term Investor

- Age: 34

- Goal: Financial freedom through passive income

- Investment Strategy: Long-term buy & hold, DRIP enabled

- Time Horizon: 15 years

Sarah’s Portfolio Allocation (Total $250,000)

| Stock / ETF | % Allocation | Yield | Annual Income |

|---|---|---|---|

| Realty Income (O) | 20% | 5.9% | $2,950 |

| Johnson & Johnson (JNJ) | 15% | 3.3% | $1,238 |

| Coca-Cola (KO) | 15% | 3.0% | $1,125 |

| Microsoft (MSFT) | 20% | 0.8% | $400 |

| ExxonMobil (XOM) | 20% | 3.8% | $1,900 |

| SCHD Dividend ETF | 10% | 3.5% | $875 |

- Total Annual Income: $8,488

- Monthly Average Income: ~$707

- With reinvestment (DRIP), she reaches $1,000/month by Year 8–10

Pro tip: By reinvesting dividends and contributing $500/month additionally, Sarah accelerates her path to financial independence.

Tax Efficiency Tips for Dividend Investors

Dividend income is great — but smart investors make sure they don’t lose a chunk of it to taxes. Here are a few strategies to maximize what you keep in your pocket.

1. Use a Tax-Advantaged Account

- Invest in a Roth IRA or Traditional IRA if eligible.

- Dividends in these accounts grow tax-free (Roth) or tax-deferred (Traditional).

- Platforms like Fidelity and Charles Schwab make IRA setups easy.

2. Understand Qualified vs. Non-Qualified Dividends

- Qualified dividends are taxed at capital gains rates (0%, 15%, or 20%).

- Non-qualified dividends (from REITs or foreign companies) are taxed as ordinary income.

- Mix your portfolio accordingly — keep REITs in IRAs!

3. Hold Long-Term

- Many stocks must be held at least 60 days around the ex-dividend date to qualify for lower tax rates.

- DRIP reinvestments count toward long-term holdings.

4. Use Tax Loss Harvesting

- Offset dividend income by selling losers in your portfolio.

- Available through platforms like M1 Finance or Wealthfront.

Pro tip: Work with a financial advisor or use tax tools like TurboTax to optimize your filing.

5 FAQ (For Quick Answers)

1. What is the best dividend stock for monthly income?

Realty Income is ideal due to its monthly dividends and consistent performance.

2. Which dividend stocks are best for beginners?

Start with stable, low-volatility names like Coca-Cola or Johnson & Johnson.

3. How much do I need to invest to earn $1,000/month in dividends?

Depends on the yield. With an average 4% dividend yield, you’d need about $300,000 invested.

4. Are ETFs better than individual dividend stocks?

ETFs offer diversification, but individual stocks offer more control and potential for higher yield.

5. Can I automate my dividend investing?

Yes! Use platforms like M1 Finance to set up automated dividend reinvestment and portfolio rebalancing.