Mortgage Refinance Rates Today: Best Deals & How to Save in 2025

Refinancing your mortgage can offer significant financial benefits, such as lower monthly payments, reduced interest rates, and the ability to access equity in your home. However, securing the best mortgage refinance rates today requires understanding the current market, assessing your financial goals, and knowing the right lenders to approach.

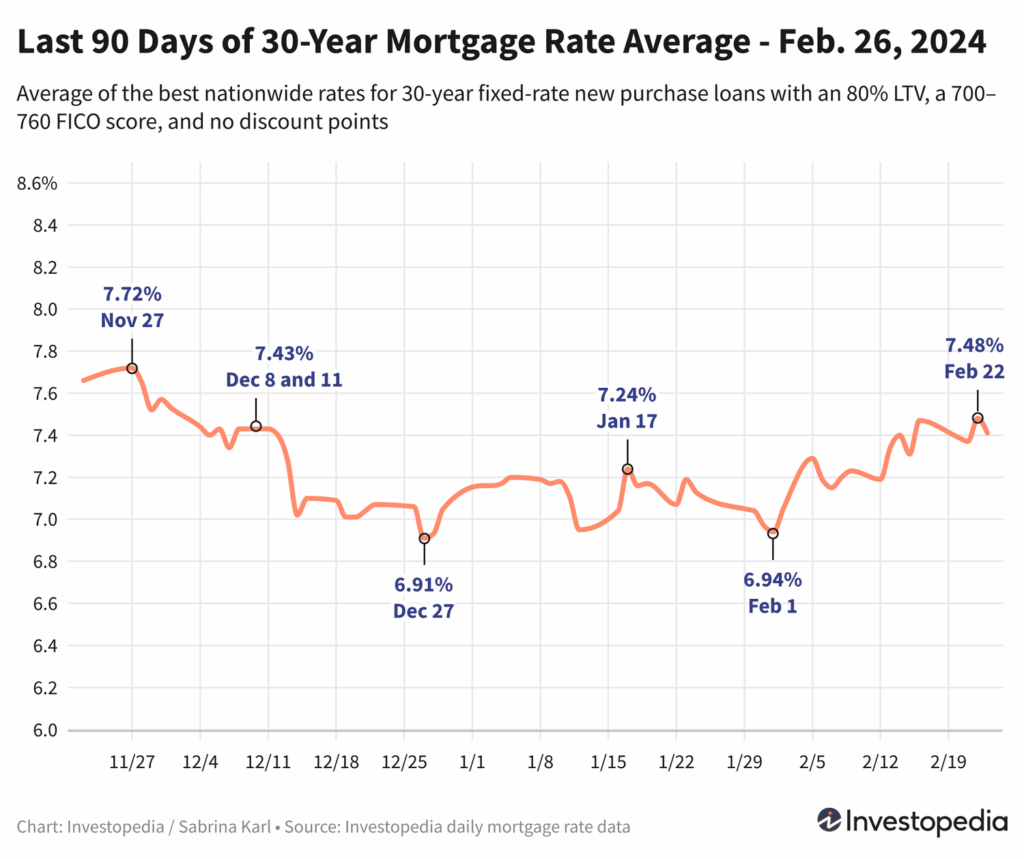

Mortgage refinance rates fluctuate daily, so it’s crucial to stay informed about the latest rates and offers available. In 2025, various factors such as the Federal Reserve’s actions, inflation, and market trends influence these rates, making it important to understand how to time your refinancing for maximum savings.

Why Should You Refinance Your Mortgage?

Refinancing your mortgage can be a powerful financial tool for homeowners looking to save money, pay off debt, or adjust their loan terms. Here’s why you might consider refinancing your mortgage:

1. Lower Interest Rates

The primary reason homeowners refinance is to secure a lower interest rate. Lower rates can significantly reduce the amount of interest you pay over the life of your loan, which results in substantial savings.

For example, if your original mortgage rate is 4.5%, and you refinance to 3.0%, you could save thousands of dollars in interest over the life of your loan. In today’s market, many borrowers are taking advantage of refinancing opportunities to lock in historically low rates.

2. Reduce Monthly Payments

Refinancing can also lower your monthly payments by extending the term of your loan. This is especially helpful if you’re facing financial difficulties or want more room in your budget. A longer loan term spreads out the repayment over a more extended period, lowering your payments.

However, be mindful that extending your loan term could mean you’ll pay more interest over time, so it’s essential to balance monthly payment reduction with long-term costs.

3. Access Home Equity

If you have built up equity in your home, refinancing gives you the option to access that equity through a cash-out refinance. This is particularly useful if you want to make home improvements, consolidate debt, or finance large expenses like education or medical bills. With a cash-out refinance, you replace your existing mortgage with a larger one, taking the difference in cash.

4. Switch Loan Types

Another reason to refinance is to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage (FRM). Fixed-rate loans provide predictable payments, making them an attractive option for homeowners seeking stability. If you have an ARM and are concerned about potential rate hikes in the future, refinancing to a fixed-rate mortgage may be the right move.

How Are Mortgage Refinance Rates Determined?

Mortgage refinance rates depend on several factors, including:

1. Credit Score

Your credit score plays a significant role in determining the rate you will qualify for. Higher credit scores typically result in lower interest rates, as lenders view you as less of a risk. Conversely, if your credit score is lower, you may face higher rates or have difficulty securing favorable terms.

2. Loan-to-Value (LTV) Ratio

The LTV ratio is the amount of your loan compared to the appraised value of your home. The higher your LTV, the riskier the loan is for lenders. To get the best refinance rates, aim for a lower LTV ratio, ideally below 80%.

3. Loan Term

The term of the loan affects the rate you receive. Shorter loan terms, such as 15 years, typically come with lower interest rates compared to longer terms like 30 years. However, shorter terms may come with higher monthly payments.

4. Market Conditions

The overall economic environment, including inflation, the Federal Reserve’s monetary policy, and bond yields, plays a significant role in mortgage refinance rates. When the Fed raises interest rates, mortgage rates tend to rise, and vice versa.

Top Mortgage Refinance Rates Today in 2025

In today’s competitive market, many lenders offer attractive refinance options for homeowners. Below are some of the best mortgage refinance rates in 2025. These rates are subject to change, so it’s essential to shop around and compare offers.

| Lender | Interest Rate | APR | Term | Loan Type | Pros | Cons | Link |

|---|---|---|---|---|---|---|---|

| LendingTree Refinance | 2.75% | 3.25% | 30 years | Fixed-Rate | Competitive rates, fast pre-approval process | May require excellent credit | Visit LendingTree |

| SoFi Mortgage Refinance | 3.00% | 3.50% | 15 years | Fixed-Rate | No fees, fast online application | High credit score needed | Visit SoFi |

| Rocket Mortgage Refinance | 2.99% | 3.40% | 30 years | Fixed-Rate | 24/7 customer support, large loan amounts | Fees could be higher for larger loans | Visit Rocket Mortgage |

| Better.com Refinance | 3.10% | 3.60% | 30 years | Fixed-Rate | No commission fees, quick process | Not available in all states | Visit Better.com |

| Chase Mortgage Refinance | 3.25% | 3.70% | 30 years | Fixed-Rate | Great customer service, flexible options | Requires a Chase account for better rates | Visit Chase |

Benefits of Refinancing Your Mortgage

1. Save Money Over Time

Refinancing your mortgage allows you to reduce your interest rate, which can save you thousands of dollars over the life of your loan. For instance, a 1% drop in your mortgage rate can save you $100 or more each month on a $200,000 loan.

2. Flexibility and Control

Refinancing gives you the flexibility to adjust your loan terms, switch loan types, or even access equity. This control helps tailor your loan to your current financial situation and long-term goals.

3. Faster Path to Homeownership

If your goal is to pay off your home sooner, refinancing to a shorter loan term (like a 15-year mortgage) allows you to do so. You’ll pay off your mortgage faster, which could save you a significant amount in interest payments.

4. Consolidate Debt and Improve Finances

Many homeowners refinance to access home equity and pay off high-interest debts like credit cards or personal loans. This consolidation strategy can simplify your finances and lower your interest rates on existing debt.

How to Refinance Your Mortgage: Step-by-Step Guide

Refinancing your mortgage is a relatively straightforward process, but there are steps involved. Here’s how to do it:

1. Evaluate Your Financial Situation

Before you start shopping for refinance rates, assess your financial goals. Are you looking to lower your monthly payments, pay off your mortgage faster, or access home equity? Understanding your goals will help you choose the right lender and loan type.

2. Shop Around for the Best Rates

Don’t settle for the first offer you see. Compare rates from multiple lenders to ensure you’re getting the best deal. Websites like LendingTree and Bankrate allow you to compare mortgage refinance rates quickly.

3. Check Your Credit Score

Your credit score is one of the most important factors in determining your refinance rate. Check your credit score and address any issues before applying for refinancing. A higher credit score can qualify you for better rates.

4. Choose the Right Loan Type

Determine whether you want a fixed-rate or adjustable-rate mortgage, as well as the term of your loan (e.g., 15 years or 30 years). Fixed-rate loans offer stability, while ARMs may offer lower initial rates but can increase over time.

5. Submit Your Application

Once you’ve chosen a lender and loan type, submit your application. Be prepared to provide documentation, such as income verification, proof of assets, and your home’s value.

6. Close Your Loan

After your application is approved, you’ll sign the necessary paperwork and close the loan. Your new loan will pay off your existing mortgage, and you’ll start making payments under the new terms.

Top Mortgage Refinance Lenders

If you’re ready to refinance, here are some of the top lenders offering competitive mortgage refinance rates today:

Each of these lenders offers a user-friendly application process and various loan options, so you can find the best fit for your needs.

Common Challenges When Refinancing Your Mortgage

Refinancing a mortgage can be a great way to save money, but it’s not always without its challenges. Here are some of the most common hurdles homeowners face during the refinancing process, along with ways to overcome them.

1. Low Credit Score

If your credit score has dropped since you originally took out your mortgage, you might not qualify for the best rates when refinancing. Many homeowners may find themselves in a situation where their credit score doesn’t meet the lender’s requirements, making it difficult to secure a lower interest rate.

How to Overcome:

- Check Your Credit Report: Request a free credit report to identify any errors. Disputing incorrect information can quickly raise your score.

- Improve Your Credit: Paying down credit card balances, avoiding late payments, and reducing your overall debt can help improve your score over time.

2. Home Value Fluctuations

The value of your home can impact your ability to refinance. If the real estate market in your area has cooled, or if your home has decreased in value, you may struggle to meet the required loan-to-value (LTV) ratio for refinancing.

How to Overcome:

- Get a Professional Appraisal: Sometimes the online estimate of your home’s value is lower than its actual worth. Consider getting a professional appraisal to ensure your home’s value is accurately assessed.

- Consider FHA or VA Loans: If you’re having difficulty meeting the LTV ratio, government-backed loans such as FHA or VA loans often have more flexible requirements.

3. High Closing Costs

Refinancing comes with closing costs that can range from 2% to 5% of your loan amount. If you’re not prepared for these costs, they could derail your refinancing efforts.

How to Overcome:

- Shop Around for Lenders: Different lenders have different closing cost structures. By comparing offers, you can find one with lower costs.

- Negotiate with Lenders: Some lenders may be willing to cover part of the closing costs, or you can choose a “no-cost refinance” where the lender covers the costs but the interest rate might be slightly higher.

4. Debt-to-Income (DTI) Ratio

Lenders also look at your debt-to-income ratio, which compares your monthly debt payments to your income. If your DTI ratio is too high, it might indicate that you’re over-leveraged, making it harder to get approved for refinancing.

How to Overcome:

- Pay Down Debt: Reducing high-interest debt, such as credit cards, can help lower your DTI ratio.

- Increase Your Income: If possible, increasing your income through a side hustle, bonus, or salary increase can help improve your DTI ratio.

When Should You Refinance Your Mortgage?

Deciding when to refinance can significantly impact the savings you achieve. While refinancing can be a good move at any time, there are certain circumstances where it can be more beneficial:

1. When Interest Rates Are Low

The most obvious time to refinance is when interest rates are lower than your current mortgage rate. A 1% or even a 0.5% drop in your rate can result in thousands of dollars in savings over the life of your loan.

Example:

- If you have a $200,000 mortgage at 4.5% interest, refinancing to a 3.0% interest rate can save you approximately $140 per month or $1,680 per year.

- Over 30 years, this could save you more than $50,000 in interest.

2. When Your Credit Score Improves

If your credit score has improved since you took out your mortgage, you could qualify for a lower rate. Refinancing at a lower rate could reduce your monthly payments or save you money in interest over time.

3. When You Want to Change Loan Terms

If you’re currently in an adjustable-rate mortgage (ARM) and want the stability of a fixed-rate mortgage, or if you want to shorten the term of your loan to pay it off faster, refinancing can help you achieve that.

- A 15-year mortgage, for example, offers a lower interest rate than a 30-year mortgage. If you have the financial flexibility, refinancing into a 15-year mortgage could help you pay off your home sooner and save on interest payments.

4. When You Want to Tap Into Home Equity

If you’ve built equity in your home, refinancing can allow you to access that equity through a cash-out refinance. This is a great option if you need to finance home improvements, consolidate debt, or pay for major expenses like college tuition or medical bills.

How to Maximize Savings with Mortgage Refinancing

While refinancing can be a great way to save money, there are some strategies to help you maximize your savings during the process.

1. Opt for a Shorter Loan Term

While refinancing into a longer loan term may lower your monthly payments, it could end up costing you more in the long run. By opting for a shorter loan term, you’ll pay off your mortgage more quickly and pay less interest.

For example, if you refinance from a 30-year mortgage to a 15-year mortgage, you might have higher monthly payments, but you’ll save a considerable amount on interest over the life of the loan.

2. Refinance When You Can Afford Closing Costs

If possible, try to pay for your closing costs out-of-pocket instead of rolling them into the loan. By paying upfront, you’ll avoid adding more debt to your mortgage and ensure that your refinance benefits outweigh the costs.

3. Shop Around for the Best Rates

Don’t settle for the first lender you find. Shop around, get multiple quotes, and compare interest rates, fees, and terms. Even a slight difference in rate can result in substantial savings over the life of your mortgage.

4. Consider the Break-Even Point

The break-even point is the point at which the savings from refinancing outweigh the costs of refinancing. If you’re planning to stay in your home for a long time, refinancing could save you money in the long run. However, if you’re planning to move soon, it might not make sense to refinance unless the savings are significant enough to cover the costs quickly.

Where to Buy: Best Lenders for Mortgage Refinance

Once you’ve done your research and are ready to refinance, the next step is choosing the best lender for your needs. Below are some of the top options for refinancing:

- LendingTree: LendingTree offers a marketplace where you can compare mortgage refinance rates from various lenders, helping you find the best deal based on your financial profile.

- SoFi: SoFi is known for offering competitive rates and no fees. It’s a great option for borrowers with good credit who want a streamlined refinance process.

- Rocket Mortgage: Rocket Mortgage is one of the largest and most trusted lenders. They offer an easy online application process and a variety of loan types to suit different needs.

- Better.com: Better.com is a great option for those looking to refinance with no commission fees and a fast, digital-first application process.

Refinancing Made Easy

Mortgage refinancing can provide significant financial benefits, including lower interest rates, reduced monthly payments, and access to home equity. By understanding how refinance rates are determined, evaluating your financial situation, and shopping around for the best offers, you can make an informed decision and maximize your savings.

With the right strategy, refinancing today can help you save money, pay off your home faster, and gain more financial control. Keep an eye on mortgage rates, assess your goals, and consider refinancing when the time is right for you.

Common Misconceptions About Refinancing Your Mortgage

While refinancing can be an excellent strategy for homeowners looking to save money or make financial adjustments, there are several myths and misconceptions that can cause confusion. Let’s clear up some of these myths to ensure you’re making an informed decision.

1. Refinancing Always Lowers Monthly Payments

One of the biggest misconceptions about refinancing is that it will always lower your monthly payments. While refinancing often leads to lower payments, this isn’t guaranteed, especially if you extend the loan term or take out a larger loan.

Truth:

Refinancing can also increase your monthly payments if you shorten the loan term. For example, refinancing from a 30-year mortgage to a 15-year mortgage could lead to higher payments, but you’d pay off your loan faster and pay less interest over the life of the loan.

2. You Need Perfect Credit to Refinance

Many homeowners believe that they need a perfect credit score to refinance. While having a higher credit score can certainly help you secure the best rates, it’s not a requirement.

Truth:

Even if you have a credit score in the 600s, you may still qualify for refinancing. However, you might face higher rates or additional fees. It’s always a good idea to shop around and see what options are available to you, even if your credit score isn’t perfect.

3. Refinancing Takes Too Long

The refinancing process can seem daunting, especially when it involves paperwork and waiting for approval. However, with many online lenders offering streamlined processes, refinancing today is often quicker and easier than many expect.

Truth:

While refinancing typically takes 30 to 45 days, many lenders have simplified the process with digital tools that allow you to submit documents online, track the status of your application, and receive faster approvals.

4. You Can Only Refinance Once

Some homeowners believe they can only refinance their mortgage once. This is not true. You can refinance multiple times if your financial situation changes or if you find a better rate in the future.

Truth:

As long as you meet the qualifications, you can refinance as many times as needed. However, be mindful of the associated closing costs and whether refinancing will still benefit you after factoring them in.

How to Compare Mortgage Refinance Offers

With so many lenders offering mortgage refinance options, it can be difficult to choose the right one for you. Here’s how to compare mortgage refinance offers effectively:

1. Interest Rates

The interest rate is the most important factor when comparing refinance offers. A lower rate can save you a significant amount of money over time. Be sure to compare the APR (annual percentage rate) as well, as it includes both the interest rate and any additional fees associated with the loan.

2. Fees and Closing Costs

Closing costs can add up quickly, and they vary from lender to lender. Some common closing costs include loan origination fees, appraisal fees, title insurance, and recording fees. Be sure to ask for a breakdown of all fees associated with the refinance.

Tip:

Consider the “no-closing-cost refinance” option, but keep in mind that these often come with higher interest rates or may require you to roll the costs into the loan.

3. Loan Terms

The loan term you choose will affect both your monthly payments and the total interest you pay over the life of the loan. Typically, the shorter the term, the lower the interest rate, but monthly payments will be higher.

- 30-year mortgages typically have lower monthly payments but higher total interest costs.

- 15-year mortgages have higher monthly payments but lower total interest costs.

4. Customer Service and Reviews

Look for lenders with strong customer service ratings and positive reviews. The refinancing process involves a lot of paperwork, and you want to ensure that you’re working with a lender who will guide you through the process and provide answers to your questions promptly.

Tip:

Check online platforms like TrustPilot, Better Business Bureau (BBB), or Google reviews to read customer experiences before committing to a lender.

Long-Term Strategies to Maximize Savings

While refinancing can offer short-term savings, it’s essential to have a long-term strategy for managing your mortgage and continuing to save money.

1. Pay Extra Toward Principal

One of the best ways to maximize the savings from refinancing is to pay extra toward your mortgage principal. Even an additional $100 or $200 per month can have a significant impact, reducing your loan balance and decreasing the amount of interest you pay over time.

2. Refinance Again When Appropriate

As mentioned earlier, you don’t have to refinance only once. If mortgage rates continue to drop after your refinance, you can take advantage of lower rates by refinancing again. This strategy can help you lock in better terms and lower rates as market conditions improve.

However, always weigh the benefits of refinancing against the associated costs to ensure you’re not paying more in fees than you’re saving.

3. Consider Your Future Plans

If you plan to stay in your home for a long time, refinancing might make more sense, especially if you can secure a fixed-rate mortgage or reduce your loan term. If you’re planning to sell your home soon, refinancing might not provide enough savings to justify the costs.

How to Buy: Getting Started with Mortgage Refinancing

Now that you know how to navigate the mortgage refinance process and maximize your savings, the next step is to take action. Here’s how to get started:

1. Evaluate Your Financial Health

Before applying for refinancing, ensure you have a good understanding of your credit score, debt-to-income ratio, and current home equity. A financial advisor can help you assess your situation and determine whether refinancing is the best option.

2. Shop Around for Lenders

Use online platforms like LendingTree, Bankrate, and Rocket Mortgage to compare rates from different lenders. Make sure you get multiple quotes and consider both online and traditional lenders.

3. Submit Your Application

Once you’ve selected a lender, submit your application. You’ll need to provide details such as income, credit score, home value, and the amount you owe on your current mortgage. Be prepared to submit documents such as tax returns, pay stubs, and bank statements.

4. Close the Loan

After your application is approved, you’ll close the loan and sign the necessary paperwork. At closing, you’ll pay any fees associated with the refinance and set up your new payment schedule. You’ll then begin making payments on your new mortgage.

Take Action to Save on Your Mortgage Today!

Mortgage refinancing can be a valuable financial tool if used wisely. With the right knowledge, strategies, and resources, you can lower your monthly payments, reduce your interest rates, or access home equity to achieve your financial goals. By following the steps outlined in this article, you’re well on your way to making an informed decision that benefits you both now and in the future.

Advanced Strategies to Maximize Your Mortgage Refinancing Benefits

While we’ve covered the basics of refinancing and how it can be an effective financial tool, there are several advanced strategies you can use to take full advantage of the refinancing process. By incorporating these strategies, you can optimize your refinancing efforts and potentially save even more money.

1. Consider Refinancing to a 15-Year Mortgage

One of the most effective ways to save money in the long term is by refinancing to a 15-year mortgage. Though your monthly payments will be higher than with a 30-year mortgage, you will pay much less interest over the life of the loan.

Why Choose a 15-Year Mortgage?

- Lower Interest Rates: A 15-year mortgage typically comes with a lower interest rate compared to a 30-year mortgage.

- Significant Interest Savings: By paying off your loan in 15 years, you’ll reduce the amount of interest paid over the life of the loan.

- Faster Debt Freedom: If you can afford the higher monthly payments, you’ll pay off your home much quicker, which can be a huge financial relief.

Example:

If you refinance a $250,000 mortgage from a 30-year term at 4.5% to a 15-year term at 3.0%, your monthly payment would rise by approximately $500. However, over the 15 years, you’d save more than $50,000 in interest.

2. Refinance into an Adjustable-Rate Mortgage (ARM)

If you’re comfortable with some risk and plan to stay in your home for only a few years, refinancing into an adjustable-rate mortgage (ARM) can save you a significant amount of money in the initial years.

How ARMs Work:

An ARM starts with a fixed interest rate for a set period (usually 5, 7, or 10 years) before adjusting to a rate based on current market conditions. Typically, ARMs offer lower initial rates than fixed-rate mortgages.

When to Consider:

- Short-Term Ownership: If you’re planning to move or sell the house before the adjustment period kicks in, you can take advantage of the lower initial rates.

- Low-Interest Rates: If market rates are low and expected to stay low for a while, an ARM can be a great option.

Example:

A 5/1 ARM might offer an interest rate of 2.5% for the first five years, compared to 4.0% on a fixed-rate mortgage. After five years, the rate will adjust, so if you plan to sell before then, you could save a lot on interest.

3. Explore Cash-Out Refinancing

Cash-out refinancing can be a great option if you need access to funds for home improvements, debt consolidation, or other major expenses. With cash-out refinancing, you refinance your current mortgage for more than you owe and take the difference in cash.

Pros of Cash-Out Refinancing:

- Access to Cash: This can be a great way to finance home renovations or consolidate high-interest debt.

- Potential Tax Benefits: In some cases, mortgage interest on a cash-out refinance may be tax-deductible if the funds are used for home improvements.

Important Considerations:

- Higher Loan Balance: With a cash-out refinance, your loan balance will increase, which could lead to higher monthly payments. Be sure you can afford the new payments before proceeding.

- Closing Costs: As with any refinance, closing costs apply, so ensure the benefits of cashing out outweigh the costs.

How to Calculate If Refinancing Is Worth It

To determine if refinancing is truly worth the cost, you should calculate your break-even point. The break-even point is the point at which your savings from refinancing exceed the closing costs you paid.

Formula for Break-Even Point:

Break-even point=Total Closing CostsMonthly Savings from Refinancing\text{Break-even point} = \frac{\text{Total Closing Costs}}{\text{Monthly Savings from Refinancing}}Break-even point=Monthly Savings from RefinancingTotal Closing Costs

For example, if your closing costs are $5,000 and your monthly savings from refinancing are $150, it would take 33 months (about 2.75 years) for the savings to exceed the costs.

Steps to Calculate:

- Add up your closing costs: This includes appraisal fees, title insurance, loan origination fees, and other associated charges.

- Calculate your monthly savings: Compare your current monthly payment with your new, lower payment. Subtract the new payment from the old one to determine your savings.

- Divide the closing costs by your monthly savings: This will give you the number of months it will take to recover the closing costs and start saving money.

Long-Term Considerations When Refinancing Your Mortgage

Refinancing your mortgage can provide short-term savings, but it’s important to think long term as well. Here are some considerations to ensure refinancing is part of a broader financial strategy.

1. Your Mortgage After Retirement

If you plan to retire soon, refinancing might offer an opportunity to reduce your mortgage payments and free up more money for retirement. However, you’ll need to evaluate whether refinancing makes sense if you’re close to paying off your mortgage.

- Consider a Shorter Loan Term: Refinancing to a 15-year mortgage in the years leading up to retirement can help you pay off your home faster, making retirement more financially secure.

- Plan for Fixed Payments: If you’re on a fixed income after retirement, refinancing to a fixed-rate mortgage ensures your payments will stay the same, providing stability in your budget.

2. Stay on Top of Interest Rate Trends

Mortgage rates fluctuate over time based on economic conditions. If you refinance and lock in a low fixed-rate mortgage, you’ll benefit from predictability and savings. However, if rates drop significantly after your refinance, it might be worth refinancing again.

To make the most of mortgage refinancing, stay informed about interest rate trends. If rates drop, you could refinance again to save even more.

3. Avoid Refinancing Too Frequently

While refinancing multiple times can help you take advantage of lower rates, doing so too often can be costly. Each refinance comes with its own set of closing costs, which can eat into your savings if you refinance too frequently. Be sure the savings you’re getting from refinancing outweigh the costs.

How to Buy a Mortgage Refinance: Final Steps

As you’re now equipped with a thorough understanding of mortgage refinancing, it’s time to take action! Here’s a quick recap of how to finalize your decision and get started:

1. Get Pre-Approved

Before shopping for refinancing options, get pre-approved by multiple lenders. This will give you a better idea of the rates and terms you qualify for, as well as any fees associated with the refinancing process.

2. Compare Lenders

Use platforms like LendingTree, Bankrate, or Rocket Mortgage to compare multiple refinance offers and choose the best one based on your needs.

3. Submit Your Application

After selecting the lender with the best offer, submit your refinance application along with the required documentation, such as proof of income, tax returns, and your current mortgage statement.

4. Close the Deal

Once your refinance application is approved, you’ll go through the closing process. Make sure you review the terms carefully and understand the costs involved before signing the final documents.

Make an Informed Mortgage Refinance Decision

Refinancing your mortgage can be a powerful financial tool if done strategically. Whether you’re looking to lower your interest rate, shorten your loan term, or tap into home equity, refinancing today could provide long-term financial benefits. By evaluating your goals, staying informed about market conditions, and comparing multiple lenders, you can make a smart refinancing decision that fits your needs.

Additional Advanced Tips for Mortgage Refinancing

Refinancing your mortgage can have far-reaching effects on your financial health if done thoughtfully. Beyond the basic strategies we’ve already discussed, there are several advanced tactics and tips that can help you make the most of your refinancing decision.

1. Consider Refinancing to a Loan with No Prepayment Penalty

Many traditional mortgages come with a prepayment penalty, meaning if you pay off your loan early (either through refinancing or making extra payments), you’ll be charged a fee. When refinancing, look for a loan that doesn’t have this penalty.

Why It Matters:

- More Flexibility: Without a prepayment penalty, you have the freedom to make extra payments without incurring additional costs.

- Faster Payoff: If you come into some extra cash (like a tax return or work bonus), you can put it toward paying off your mortgage early without fear of penalties.

2. Leverage Your Home Equity to Eliminate Debt

Refinancing can also be a strategy to help you consolidate debt, especially high-interest credit card debt. If you have built up enough equity in your home, you can use a cash-out refinance to pay off other debts, saving you money on high interest rates.

Example:

Imagine you owe $30,000 in credit card debt with an average interest rate of 20%. If you refinance your mortgage and take out enough cash to pay off that debt, you could save a significant amount of money on interest, especially if you’re refinancing to a lower-rate mortgage.

3. Look for Lender Incentives and Discounts

Some lenders offer special promotions or discounts on closing costs for refinancing customers, especially if you already have an existing relationship with them. Don’t be afraid to ask your current lender about any refinancing incentives they offer.

Examples of Incentives:

- Reduced Closing Costs: Some lenders will offer reduced or waived closing costs as a way to keep you as a customer.

- Discounted Interest Rates: If you’re refinancing with your current lender, they may offer a better rate to keep your business.

4. Refinance as Part of a Larger Financial Plan

Mortgage refinancing isn’t just about reducing your monthly payment or accessing cash; it can also be part of a larger financial strategy. If you’re nearing retirement, for example, refinancing could allow you to free up extra cash or shorten your loan term.

How It Fits Into Long-Term Planning:

- Planning for Retirement: If your goal is to pay off your mortgage before you retire, refinancing to a shorter term could help you achieve that goal.

- Estate Planning: If you’re planning to leave your home to heirs, refinancing to a lower rate could help them inherit a home with lower ongoing costs.

5. Be Strategic About Refinancing Timing

Choosing the right time to refinance can make a big difference in the savings you’re able to unlock. Market conditions, personal financial changes, and other factors can all influence whether it’s the right time to refinance.

Things to Consider:

- Interest Rate Trends: Refinancing when interest rates are at a historical low will help you lock in savings for the long term. Track rate trends through financial websites or speak with a lender.

- Life Events: Major life events (like marriage, the birth of a child, or a significant change in income) can affect your ability to refinance successfully. Take advantage of favorable financial conditions to lock in a great rate.

Refinancing Mortgage Use Cases: Real-Life Scenarios

Here are a few examples of real-life situations where refinancing makes a lot of sense, and how homeowners have successfully used refinancing to achieve their financial goals.

1. First-Time Homebuyers Looking to Save

Suppose you bought your home a few years ago with an adjustable-rate mortgage (ARM) because the initial rate was lower. However, after a few years, the rate is set to increase, and your monthly payments are becoming unaffordable.

Solution:

By refinancing into a fixed-rate mortgage, you can lock in a stable, lower interest rate and avoid future rate increases. This ensures that your monthly payments remain predictable and manageable for the long term.

2. Homeowners Looking to Shorten Their Loan Term

If you purchased your home with a 30-year mortgage, but your income has increased, you may want to pay off your home sooner to save money on interest.

Solution:

Refinancing to a 15-year mortgage can help you achieve this goal, with the added benefit of a lower interest rate. Your monthly payments will be higher, but you’ll pay off your home more quickly and save on interest over the life of the loan.

3. Debt Consolidation to Lower Financial Stress

Imagine you have several high-interest debts (credit cards, personal loans, etc.) and are struggling to keep up with payments. Refinancing your mortgage to take out extra cash can allow you to pay off those high-interest debts at a much lower interest rate.

Solution:

Using a cash-out refinance to consolidate your debts can help reduce your monthly financial obligations. You’ll pay off high-interest loans and simplify your finances, all while locking in a lower mortgage rate.

Comparing Refinancing Offers: What to Look For

Now that you’re armed with additional insights into how refinancing can benefit you, it’s time to compare different refinancing offers. Below, we will discuss key factors you should consider when evaluating your refinancing options.

Key Comparison Factors for Refinancing Offers

| Factor | Option 1: Lender A | Option 2: Lender B | Option 3: Lender C |

|---|---|---|---|

| Interest Rate | 3.25% (Fixed) | 3.0% (Fixed) | 2.8% (Adjustable, 5/1 ARM) |

| Closing Costs | $3,000 | $3,200 | $2,500 |

| Loan Term | 30 years | 20 years | 15 years |

| Monthly Payment | $1,000 | $1,400 | $1,600 |

| Features | No prepayment penalty | Discounted rate for current customers | Lower initial rate (5-year fixed) |

| Pros | Low interest rate, stable payments | Lower closing costs, flexible terms | Lowest initial rate, potential savings on interest |

| Cons | Higher closing costs | Slightly higher monthly payments | Adjustable rate could increase after 5 years |

| Best For | Homeowners who want stability | Homeowners who want flexibility | Homeowners who plan to sell soon or refinance again |

Key Takeaways:

- Lender A offers a stable, predictable loan with a longer term. Ideal for those who want the peace of mind of fixed monthly payments.

- Lender B offers slightly higher monthly payments but may be more beneficial for those who plan to stay in their home for a shorter period.

- Lender C offers the lowest initial interest rate, making it ideal for homeowners who intend to sell or refinance again before the rate adjusts.

Empower Yourself to Make the Right Refinancing Decision

Refinancing is a powerful tool that can provide significant financial benefits, from reducing monthly payments to accessing cash for home improvements or debt consolidation. By understanding the process, comparing options, and considering advanced strategies, you can make the best choice for your situation.

It’s also crucial to continue tracking mortgage rates, as refinancing opportunities can vary depending on the economy and interest rate fluctuations. Always consider your long-term goals and financial stability when making the decision to refinance.

Frequently Asked Questions (FAQs)

1. Should I refinance if my credit score has dropped?

If your credit score has dropped significantly, it might be harder to get the best rates. However, you can still refinance, but you may face higher rates. Consider speaking with a mortgage professional to see what your options are.

2. What’s the best time of year to refinance my mortgage?

The best time to refinance is when interest rates are low. Historically, mortgage rates tend to be lower in the winter months, but it’s important to monitor rates year-round to find the best deal.

3. Can I refinance my mortgage if I’ve only owned my home for one year?

Yes, you can refinance after one year, but your options may be limited. Many lenders require you to have at least 20% equity in your home, so if you bought with little down payment, it might take longer to build that equity.

4. Can refinancing my mortgage affect my insurance rates?

Typically, refinancing doesn’t directly affect your homeowners’ insurance rates. However, if the refinance involves cashing out a portion of your home’s equity, you might need to update your coverage.

5. Should I refinance even if I’m planning to move in a few years?

Refinancing might not be worth it if you plan to move in the next few years, especially considering the closing costs. However, if you’re refinancing into a lower rate and will save money in the short term, it may still be a good option.